Adjustable-amount mortgages normally have additional favorable desire costs than set-price mortgages, Primarily in the course of the introductory period of time. Just after the primary a few to 10 years, the mortgage level adjustments dependant on marketplace situations and may go up or down determined by your personal loan paperwork.

Northpointe Financial institution shoots ahead of your pack regarding pace (the two preapproval and shutting occasions are swift in comparison with most other lenders) as well as the range of home loans it provides.

We hire mystery shoppers to call our suppliers anonymously and Consider them. Companies who respond immediately, reply queries carefully, and converse politely score higher.

Freelancers could also be regarded for just a mortgage furnished they are able to establish a steady stream of money, only through the Czech Republic not from overseas.

We employ secret buyers to connect with our companies anonymously and Assess them. Companies who respond rapidly, solution concerns completely, and converse politely score greater.

A mortgage broker is usually a licensed and controlled financial Qualified who functions as an intermediary amongst borrowers and lenders. Brokers identify financial loans that meet borrower desires and then Examine premiums and conditions Hence the homebuyer doesn’t have to.

Adjustable-level mortgages generally have more favorable fascination rates than preset-fee mortgages, Specifically over the introductory period of time. Right after the initial three to ten years, the mortgage level alterations based upon current market problems and can go up or down determined by your bank loan documents.

Financial institutions and mortgage suppliers use a variety of standards to find out anyone’s mortgage eligibility. To complicate matters, Each individual financial institution has its have policy and specs about a foreigner’s eligibility.

Give evidence of revenue and property. Copies of paperwork including modern paystubs, W-2s, tax returns and bank statements aid exhibit your fiscal security and ability to repay the mortgage.

This website will not be affiliated with The federal government, and our company is not authorized by The federal government or your lender.

To find the finest mortgage lender for your needs, begin by checking your here credit history score. When you have reasonable credit or down below, using steps to help your score will let you qualify for reasonably priced mortgage phrases.

A personal loan officer, However, operates for a person bank or other direct lender and will only provide mortgage products available by means of that establishment.

In addition, contrary to financial loan officers who function for certain financial institutions, mortgage brokers have usage of a broader variety of mortgage merchandise—meaning borrowers might be able to get a lot more favorable interest rates.

Nonetheless, it is possible to apply even with out a residency permit (by way of example, some EU citizens working within the Czech Republic don’t Have a very allow as it is not needed and may continue to be authorised for any mortgage).

Rider Strong Then & Now!

Rider Strong Then & Now! Joseph Mazzello Then & Now!

Joseph Mazzello Then & Now! Mike Vitar Then & Now!

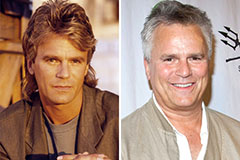

Mike Vitar Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now! Stephen Hawking Then & Now!

Stephen Hawking Then & Now!